Never a dull moment we tell you. My father, (bless his soul), always used to say (with reference to himself, or so I have always assumed), “there is no rest for the wicked”.

But never a dull moment indeed. The graph below is that of the New York Stock Exchange Composite Index over the last ten years. We have written much about the reasons for the long, almost uninterrupted, bull run since the time-of-the-big-trouble – as we call it. The short and precipitous Covid-19 interruption in March 2020 is especially noticeable.

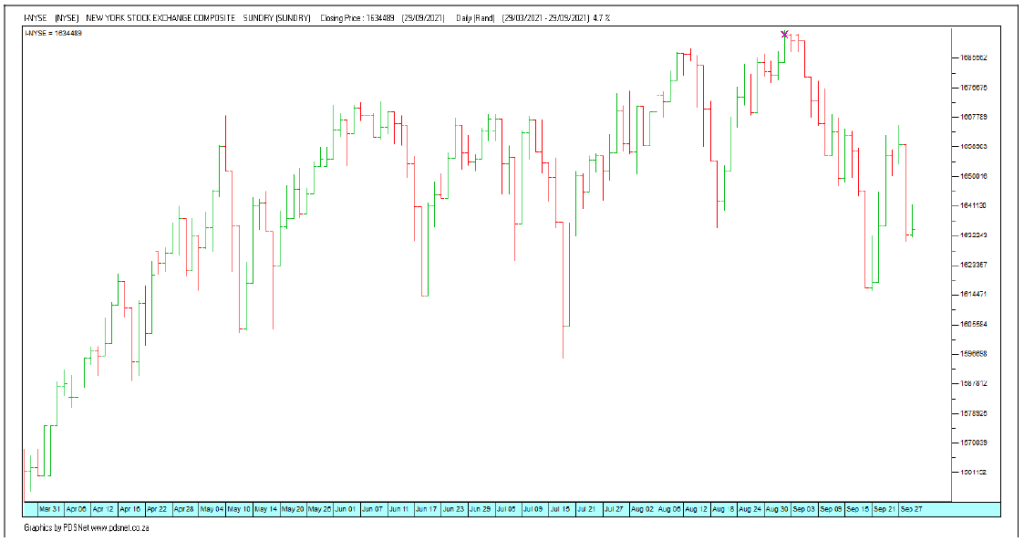

This index reached a fresh (or new) high of 16590 on 7 May 2021. Since then, it has gyrated up and down a number of times but, nevertheless, recorded a new high of 16926 on 2 September 2021. The spot is marked by the purple “x”. See the graph below.

Since that time, the international equity markets have been much softer, and this recent softness are attributable to mainly four fear factors.

- The world-wide fear of rising interest rates.

- Energy scarcity and rising energy prices in China, Europe, USA, and elsewhere.

- Rising inflation in the US and Europe. Obviously higher inflation and higher interest rates are associated with one another.

- The interference of China in what elsewhere in the world is assumed to be private enterprise. Equity markets do not particularly like such uninvited interference.

In this edition of Some Notes, we discuss each of these factors briefly.

Federal Open Market Committee – Inching closer to less stimulus

At its meeting on 23 September 2021, the FOMC made no changes to the settings of its policy instruments – for now. This was widely expected.

The current Federal funds target range was maintained at 0.00%-0.25%, and the pace of asset purchases was kept as at least $80bn of Treasuries and $40bn of agency mortgage-backed securities.

Although it gave no firm commitment to the timing of a reduction of the current level of stimulus, the FOMC most certainly confirmed that, should the current progress of inflation and employment goals continue broadly as expected, tapering will be warranted in the not-too-distant future. It further hinted that definite tapering may be announced at its November meeting, and that it may aim to conclude purchases around the middle of 2022.

The FOMC confirmed that maximum employment could easily be met soon. In addition, current and expected economic growth is strong. This is despite slower near-term growth mainly caused by sectors that were

especially hard hit by the pandemic, as well as those sectors ill affected by supply constraints like the global semiconductor shortage.

The FOMC meeting also described inflation as “elevated”, rather than merely rising, as it had done in July. This was caused by rising prices of various products and commodities post pandemic. If elevated rates of inflation persist, it will most certainly respond to return inflation to target.

Updated economic projections are as follow:

GDP growth of 5.9% is expected for 2021, less than the 7.0% expected at the June meeting. Future expected growth is however a little faster than previously expected. For 2022, 3.8% rather than 3.3%, and for 2023, 2.5% rather than 2.4%.

Inflation forecast in 2021 is 4.2%, upped from 3.4%, and the 2022 forecast 2.2% instead of 2.1%. As regards unemployment, FOMC members nudged up their 2021 forecast from 4.5% to 4.8% but kept predictions for the unemployment rate beyond that unchanged, expecting a fall to 3.8% in 2022 and 3.5% in 2023.

The interest rate outlook is interesting. The Chairman, Jerome Powell, reiterated that the hurdle to hiking rates is greater than to stop asset purchases. Even so, half the FOMC participants (9 out of 18) now expect these conditions to be met and rate hikes to begin next year; two more than in June. By end-2023, all but one of the FOMC members expect rates to be higher than now. The June number was 13 out of 18. And by 2024, every member anticipates rates to have been raised. There is, however, a very wide range of views on how much tightening will be needed by then: the lowest forecast for appropriate policy rates by then is 0.50-0.75%, and the highest 2.25-2.50%.

In summary, the balance of probability has clearly shifted towards tapering starting in November rather than in December. But nothing about the future is sure, as the rest of our essay will show.

The relevance of the FOMC meeting for world markets, and especially equity markets, is the fact that low interest rates are a powerful fuel for US and international equity markets. The USA equity markets remain the main manufacturer of world equity market sentiment.

(Source 1 and 2)

China

In the first decade of this century, Chinese growth averaged above ten percent, and in the next decade nearly eight percent. Sustaining such growth rates becomes almost impossible, with much key investment already having taken place. In addition, a slowing population growth reduces the rise in demand over time. During the next decade China’s growth will be far lower. To raise the living standards of millions far away from the prosperity of the eastern seaboard, China must maintain a high economic growth rate for many years to come. Above all, China needs to grow to ensure political peace and stability.

The recent crackdown on private business is portrayed by the Chinese as part of a move toward a more equitable and sustainable economy through the advance of Party General Secretary and President Xi Jinping’s ‘common prosperity’ drive. It also aims to improve corporate governance, reduce speculation, as well as enhance the environment. But there is more to this.

The most apt analogy for this crackdown, is that of the Cultural Revolution in the late 1960’s. This was when Mao Tse Tung effectively turned the party on itself to target opponents and enhance his own position.

Recent events are all about large Chinese corporations and high-profile entrepreneurs being brought to heel. The party is afraid that the tech sector is far too large and has been exercising social influence at odds with the discipline the Party wants. And while cracking down on tech, it is a good time to also deal with property speculation and emissions and gun for high profile people in business. Rather than drag this out over a long time, the view from the top may be to get this all done in short of a year and put the country on a new course.

This amounts to another evolution of the Chinese economic model. In the early 1970’s the model consisted of what Deng Xiaoping called ‘crossing the river feeling pebbles’. That is careful steps in the direction of liberalization. Gradually overall regulation loosened, albeit with the state and party still exercising control, often through the allocation of credit. Now Xi has reasserted control, largely out of fear of what a free private sector could mean for the future of the Party.

Taking a view on ways to enhance the power of the Party must be a very long term one, and the Party probably accepts that the crackdown will slow growth. But they clearly do not want some of the risks that go with capitalism – booms and busts, different views, and the growth of a vociferous middle class.

More about China

Evergrande, China’s second largest property developer, might be close to collapse, posing immense risks for the country’s financial stability and growth. Late September the company failed to pay some of its bond holders, but it still has about a month left before it can be declared in default. Even if the company does not default and is bailed out, the entire episode will severely test the ability of the Chinese authorities to manage a crisis. The Chinese central bank has more than enough reserves to arrange a bailout and deal with the fallout. Whether or not the government chooses to bail out the company, or decides to teach investors a lesson, there will be contagion and less faith in the Chinese economic model.

In 2008, the US chose not to bail out Lehman Brothers from a crisis which was also centered on the property sector. That triggered a wider banking crisis and was only resolved after a massive bailout for the country’s largest financial institutions. The smaller scale of the current problem in relation to the economy, the power of the central bank, and the economy’s still strong growth rate, mean that it probably cannot be compared to the Lehman Brothers crisis.

What the Evergrande episode shows, is that the Chinese model of capitalism is not immune to over- investment, bubbles, busts, and ensuing financial crises. It also shows that some of the stellar growth which has taken billions out of poverty since the late 1970’s, may have been on a shaky basis in recent years. Although the country can still generate exceptional growth, household and corporate debt levels are highly problematic. A further problem is that in the next decade China’s growth will slow significantly.

Evergrande’s distress, and the problems of other companies in the Chinese property sector, mark the end of a massive bubble. Property development has been one of the great engines of Chinese growth, in part because of the rapid rate of building and re-building. There are many cases where swathes of older apartment blocks are torn down and replaced with far bigger complexes. With property development comes infrastructure development, which helps to further generate growth. Today the property sector counts for around 30 percent of the country’s GDP.

For at least the past twenty years, the sector has been in an ever-growing speculative bubble, with much of this financed by debt. Accounts have been coming out of China for years, about empty apartment buildings and office blocks in the country’s major cities and of highways with few cars.

One of the political problems with the bursting of the bubble, is that many Chinese, not all of them wealthy or middle class, have borrowed to speculate on the rise of the sector. They have now been caught out and this might contribute to political dissatisfaction with the party. Holders of Evergrande financial instruments have already protested in Beijing, according to Bloomberg. How this is resolved in a transparent and fair manner, is an enormous test for China.

The Chinese Communist Party is a past master in using the dark arts of propaganda and political management. It cannot be coincidence that in less than a year, China’s private sector is going through such an immense series of challenges.

Evergrande’s distress comes months after the Chinese crackdown on the tech sector, with restrictions on gaming, online education, the type of algorithms than can be used, and the banning of anything connected with cryptocurrencies. Prominent entrepreneurs like Jack Ma, founder of Alibaba, as well as others, have found themselves effectively silenced, and some are in prison.

The Evergrande crisis has been years in the making but was triggered by the state with its declaration that ‘three red lines’ must not be crossed to maintain debt ratios at cautious levels. Evergrande was unable to meet these ‘red lines’ and as it was prevented from taking additional loans, it was forced into a liquidity crisis.

Also, state-induced, is the current growth slowdown due to power shortages brought on by the Chinese boycott of Australian coal. The Chinese authorities are also enforcing lower emission targets ahead of the planned decline after 2030. One of the consequences has been large-scale cutbacks in factory production.

(Source 3)

Energy in China

Key manufacturing and shipping hubs in China have been hit by energy-use restrictions as the Chinese government works to make President Xi Jinping’s carbon neutral goals a reality. The power shortage comes at a time when coal and gas prices are surging in the country as demand for Chinese products booms. The outages threaten to further exacerbate the global supply-chain crisis, which has burgeoned from Covid-19 shutdowns, paired with a buying frenzy. The power shortage has forced several key suppliers for major companies like Apple and Tesla to suspend production.

Power outages in heavy shipping regions like Guangdong, paired with China’s zero tolerance policy for Covid-19, could make it harder for the country to export key products.

In particular, the outages could have an impact on the global computer-chip shortage – a crisis that has left major tech companies scrambling for the product that go in everything from cars, to dishwashers, computers, and gaming consoles. Kushnan, an electronics-manufacturing hub, has been heavily impacted by the energy shortage. More than 10 Taiwan-based semiconductor companies in the area have announced this week that they are closing their facilities until the end of the month, The Wall Street Journal reported.

Three Taiwanese electronics companies that supply Apple and Tesla, warned on Sunday (26 September) that they had been forced to halt production at some of their factories in China. This is a serious concern for car and electronics manufacturers. Sometime during September, Toyota announced about a 50% cut in world-wide production.

Apple semiconductor supplier, Unimicron Technology, said on Sunday (26 September) that three of its subsidiaries in China had moved to stop production from Monday until Thursday to comply with China’s policy. The company said it did not expect the shutdown to have a significant impact, because other plants could help offset production losses.

A Foxconn affiliate, Eson Precision Engineering Company, said it suspended production from Sunday to Friday. The electronics company did not comment on the issue, but Reuters said the chipmaker had to diminish its capacity in facilities in Kunshan.

The outages have been focused in areas where smartphones are assembled. Pegatron, a firm that supplies and assembles elements for Apple’s iPhones, said on Tuesday (28 September) that it is reducing its energy consumption to cooperate with local government. The company has a major factory in Kunshan.

A supplier of speaker parts for the iPhone, Concraft Holding, has also halted production for five days in the last week of September.

Two of the largest Taiwanese chipmakers, Chipmakers United Microelectronics Corp and Taiwan Semiconductor Manufacturing, told Reuters they have not been impacted by the energy constraints. The New York Times reported that several key electronics suppliers in China had not been forced to limit energy use, suggesting that Beijing may not be enforcing the limitations on its own advanced manufacturing sector.

To quote Larry Hu, chief China economist at Macquarie Group, “It’s clear by now that Beijing is willing to sacrifice higher growth this year in exchange for structural reforms in some areas.”

(Source 4)

Energy in the UK and Europe

Rich, powerful economies in Europe are threatened by their own energy policies. In Britain, surging energy prices have shut down two critical fertiliser factories, which also produce crucial industrial gases such as CO2, used for foodstuffs and beverages. At one stage this month (September), Britain had to pay 8,000 SA cents

/kWh (kilowatt/hour) for electricity (£4000/MWh). This compares with Eskom’s average selling price of about 100 cents/kWh. Britain had to make a payment for electricity that was 80 times higher than our price SA Eskom price.

Furthermore, in central and western Europe, energy prices are soaring, threatening critical industries, making it impossible for poor people to pay energy bills.

There are two main reasons. The first is the increasing use of wind and solar power for grid electricity, at a huge cost. It has been an expensive disaster. In Germany, the mad ‘energiewende’ is phasing out cheap, safe, clean, reliable nuclear energy and replacing it with expensive, unreliable solar and wind power.

The predictable result has been rocketing final electricity prices, condemning some of the citizens of Germany, perhaps the most powerful industrial nation on earth, to energy poverty. Because wind and solar are useless for grid electricity, Germany must turn to the burning of very dirty coal to keep the lights on. This has obviously increased CO2 emissions recently.

In Britain the situation may be worse. The British Industrial Revolution, which changed the world for the better, was based on coal, but the ruling elite in Britain now regards coal and other fossil fuels as satanic. It has tried to shut down the coal stations, or, even worse, as in the Drax station, to convert them to burning wood, imported from the US, with calamitous environmental consequences.

Britain has spent astronomical amounts in building a huge fleet of wind turbines onshore and offshore. Another expensive disaster. It proves the falsehood of the assumption that the wind is always blowing somewhere. The problem is that the wind is not always blowing strongly enough somewhere to provide reliable energy generally. Time and again, wind over the whole of the UK, including vast offshore areas, is blowing so feebly as to provide next to no electricity.

The second reason is rapidly rising natural gas prices. Objectively, natural gas is a clean, reliable fuel, consisting mainly of methane (CH4). Europe depends more and more on gas imported from Russia. Recently, Mr Putin decided to reduce gas exports to the lowest allowable volume under the Russian/European gas contract. At the same time, energy demand across the UK and Europe was rising with the economic recovery from Covid-19 slump. The result was a sharp increase in European energy prices. Making the situation worse for Britain, was a fire on an ‘interconnector’ cable bringing nuclear electricity from France to Britain.

Winter approaches in Europe. It will increase energy demand and is a threatening crisis. This year’s UN COP (Conference of the Parties) climate conference in Glasgow in October sometime will be interesting.

What about South Africa?

Our own Integrated Resources Plan 2019 (IRP2019) calls on immense amounts of natural gas to supplement solar and wind in its ‘least cost’ option. This is very expensive, second only to the even more expensive option of solar, wind and batteries.

The IRP wants us to set up a massive gas system of pipelines, receiving terminals, deliquefying stations and compressors, at enormous cost. Here gas is assumed to be green and benevolent. But when it comes to fracking and power ships, the exact same gas is dirty and malevolent.

South Africa, unlike Britain and Germany, does not have interconnectors from neighbouring countries generating enough electricity to rescue us. Solar and wind have proved an expensive disaster, yet the rich green establishment wants to force more upon us. We have little natural gas of our own, so the greens want us to depend on imported natural gas, with highly volatile international prices.

Any chance we can learn from the folly of Europe? (Source 4)

So, Quo Vadis Equity Markets?

Over the last almost 30 years (and longer), the December and March quarters have a history of higher returns than the June and September quarters. The Covid shock to equity markets last year has reduced the March quarter average drastically. And of course, increased the June quarter in a like manner.

This will of course be great if we see a repeat of the normal pattern.

World equity markets are currently in a space where all-time highs were achieved very recently. That by itself is a good reason to expect markets to be marked down a little. Through history we have seen this repeated many times, and such patterns are clearly discernible in the 10-year graph of the NYSE Composite Index below.

Headwinds come and go. As they have done in the past. Equity markets are free and efficient and find solutions to what sometimes seem to be serious setbacks or problems. Mostly they turn out to be temporary.

Equity markets have a long history of inflation-beating returns, and amply so. Choosing high quality equities in a well-diversified portfolio will not disappoint. Avoid holding cash as an investment.

Exciting times are ahead. We proceed, as usual, with caution.

Regarding the value of our ZAR: In world terms a bias for a weaker rand remains in play in the market, with the US dollar and US treasury yields continuing to gain momentum. The rand’s woes have also been closely tied to turmoil in China, which is one of South Africa’s biggest commodity export markets. We expect the rand to be on the backfoot during the coming months.

Source 1: FAL7Shores Research

Source 2: Investec Economics. 24 September 2021.

Source 3: Johnathan Katzenellenbogen. The Evergrande crisis and China’s future. The Daily Friend. 29 September 2021. Source 4: Harry Robertson. China Notes. Business Insider USA. 30 September 2021

Source 5: Andrew Kenny. Soaring Energy Prices in Europe. Daily Friend. 26 September 2021